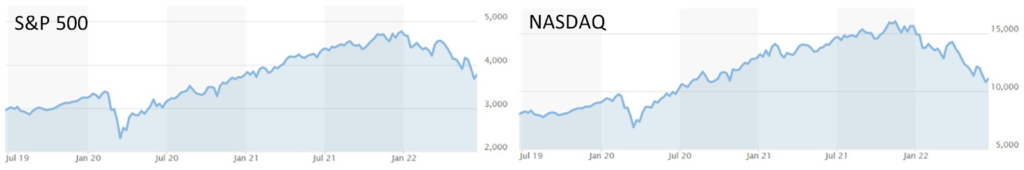

How do we make sense of these market environments, where the S&P 500 is down over 20% and the NASDAQ is down over 30%? The first thought might be to compare what the last 20-30% corrections (the term we use for when the market declines) looked like to estimate what the market might do next, and when we should expect those things to happen. This, however, can be problematic, because, like all things in life, there are far too many variables to make an apples-to-apples comparison.

The last correction of 20% or more was March 2020 (the COVID Crash. From February 19th, 2020 to March 23rd, 2020, the market dropped 33.9% – only 33 days! But, by July, just a short four months later, the market was already back to pre-COVID Crash levels.

Does that mean we should expect things to be ok again by October / November 2022?

No – and we should put those expectations away.

Why? After all, the market doesn’t drop that low that often – shouldn’t that recent correction be a good litmus test to measure the way ahead?

The March 2020 correction should surely be a PIECE of the assessments we do when looking at historical market action, though it should be considered relative to many other variables. The market environment today looks far different from the market environment of 2020, with an even greater disparity when compared to market corrections of decades earlier.

In 2022, these are some of the variables affecting the market and the economy (which affects the markets):

- Investors can trade from anywhere, any time – including from their mobile phone on their lunch break on a random Tuesday, or done automatically with every payday deposit.

- Information, globally, has never been more accessible and in real-time… Informational advantages of decades past that could give an investor a head-start in trading activity are much smaller now.

- Cryptocurrency, widely considered to be its own asset class, and associated crypto markets are open for trading 24 hours per day, seven days per week.

- The Federal Reserve manipulating rates, and not in subtle ways, in an attempt to put the reins on runaway inflation numbers.

- Global supply chain nightmares – no explanation necessary here if you’ve tried to do anything from buy a new car, buy some lumber to do a small at-home project, or even just the bag of chips you normally buy but now cannot find…

This can be worrisome to consider, as now we pair a 20-30% correction with unfamiliar territory, though it’s worth considering that EVERY market correction in history has been in “unfamiliar territory.” Just rewind yourself again to March 2020 and try to remember the thoughts we had when the market got beat up really fast, and we were faced with lockdowns, masks, inability to travel (or even work), due to the global pandemic. Somehow, though, life carried on forward.

Take that reflection further and contemplate this data comparing the pre-COVID Crash levels with current levels:

The S&P 500 went from 3,386.15 (Feb 19, 2020) to 3,764.79 (Jun 21, 2022) – an 11.2% return over that period, equaling annual growth of 4.8%.

The NASDAQ went from 9,817.18 (Feb 19, 2020) to 11,069.30 (Jun 21, 2022) – a 12.8% return over that period, equaling annual growth of 5.5%.

Source: MarketWatch

Now, there are a few things to consider with this data. First, most data can be manipulated to support any given argument, though my point with this data presented as such is to emphasize that, over the longer term, the markets have continued to have a positive trajectory. Second, if you had been asleep since February 2020, you’d be disappointed in the laggard growth (given the S&P 500 averages about 7% growth per year (adjusted for inflation), though you’d likely also be less anxious than many investors find themselves actually feeling right now. It ALWAYS seems to feel worse when you’re inside the turmoil, though more dismissible once it’s in the past. To be clear, 5% annual returns isn’t horrible, and to conservative investors, that’s a solid return. What causes someone to be less optimistic, however, is when their portfolio has lost 20% in the last six months. Simply knowing that definitely puts a damper on the optimism.

In The Psychology of Money, author Morgan Housel reminds us that:

“Optimism is usually defined by a belief that things will go well. But that’s incomplete. Sensible optimism is a belief that the odds are in your favor, and over time things will balance out to a good outcome even if what happens in between is filled with misery. You can be optimistic that the long-term growth trajectory is up and to the right, but equally sure that the road between now and then is filled with landmines, and always will be. Those two things are not mutually exclusive.”

While sheer optimism will do nothing to help your portfolio, the consideration that the sometimes-tumultuous day-to-day and week-to-week activity of the markets is the price we all pay for what comes with long-term investing: positive trajectory. Positive growth will not happen daily, though history tells us that positive growth is extremely likely over longer periods

So, what good is an advisor who doesn’t know what will happen next in the markets? The value lies in understanding the bigger picture. The long game. The view from 30,000 feet, not the one from the forest floor. The last piece I wrote discussed focusing on what you can control, and the theme of this parallels that idea with remembering the bigger picture. The value of an advisor comes in the careful consideration of making any changes to a portfolio, considering tax implications or lost opportunity in market recovery if they were simply to react to the market ebbs and flows.

There’s nobody that knows what the market will look like in three or six months – anyone saying otherwise would not be saying it, because they would likely keep that information private for the sake of capitalizing on it as much as possible. We surely don’t plan to predict what the market will look like, but we will tell you that the chances of the market continuing its positive trajectory over the longer term are high.

For those in their younger years, or those who still wish to grow their capital, that might mean staying patient and focusing on your monthly cash flow needs while contributing / investing as much as that cash flow allows. For those where capital growth is not the primary goal, establishing a set amount of cash aside to facilitate monthly cash flow needs is the priority (six or 12 months worth of cash, maybe), and preserving the remainder of capital (and protecting it from inflation w/sensible investing) can complement that.

Stay optimistic. Zoom out to the bigger picture.